Trend vs Chop

We’ve had a slight change of heart about the Group Therapy recording for Part 2 of the “Keeping It Simple” special. We have decided to make it public. Admittedly, this is partly because Camtasia kept crashing my PC as I tried to edit the video that I’d recorded in 4k mode.

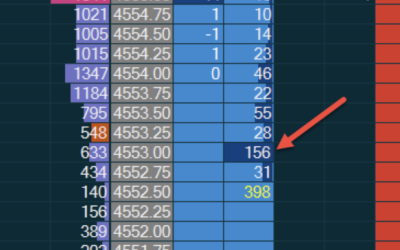

In this event, we go through ways to identify if a market is reverting to chop. We consider this one of the most important trading decisions for the simple reason that trend and chop require opposing strategies. Charts will tell you when a market is in chop mode but you will need to see 3 or more hits to the range boundaries to see it. With the approach outlined in this video, you will see it as it builds and before it’s visible on a chart.

In the next group therapy, we’ll be taking a look at “CB” – who will be anonymous till we get into the meeting. He has outlined his issues in email and we will take a look at what he’s doing and why after 11 years, he’s still struggling. I am not sure yet if I will talk to him about his trading prior to the meeting. There’s a part of me that says we should discover this all together and another that is telling me that’s asking for trouble. Trouble usually wins and I think it’ll be more interesting if we look at this together.

Date’s will be announced in the coming days as CB and I firm up the plan.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments