Group Therapy – Trading The Idiot Zone & Scaling Into Trades

In this months trader group therapy, we are going to look into 2 timely issues impacting traders right now. We’ll be meeting at May 23rd, 12pm Eastern Time. Click here to register for the webinar.

For those that don’t know, the group therapy sessions are informal and interactive sessions, where we discuss a topic together. I prepare discussion points and give my view and then we open up the floor for discussion. It’s educational, interesting and a sociable event. It’s a way for us to share our experiences and learn from others. And of course, it’s just nice to be around fellow traders. When you are in the session, you will see everyone’s comments & they will see yours. So bear that in mind when you register.

We’ll cover 2 main topics today:

- Trading the Idiot Zone – How to handle the fact that one day you can feel like a guru and the next you can feel like there’s literally nothing you can do right. You feel like you have entered – the idiot zone. We’ll examine some of the grey areas between the “do’s and don’ts” of trading and how to navigate them.

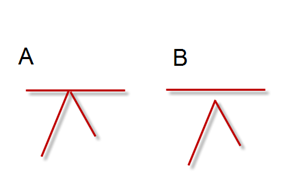

- Scaling – something that can destroy your account very quickly if you attempt to use it in place of good trade location. Also something that can be used in a number of situations where all in/all out might not be optimal. We’ll discuss scaling specifically as it relates to trading the current market conditions with the China Trade War & issues with Iran.

Please do send through questions/comments ahead of time – especially market specific ones where I might need to grab screen shots of have a particular market DOM to hand.

Click here to register for the webinar.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments