Trading The Crash

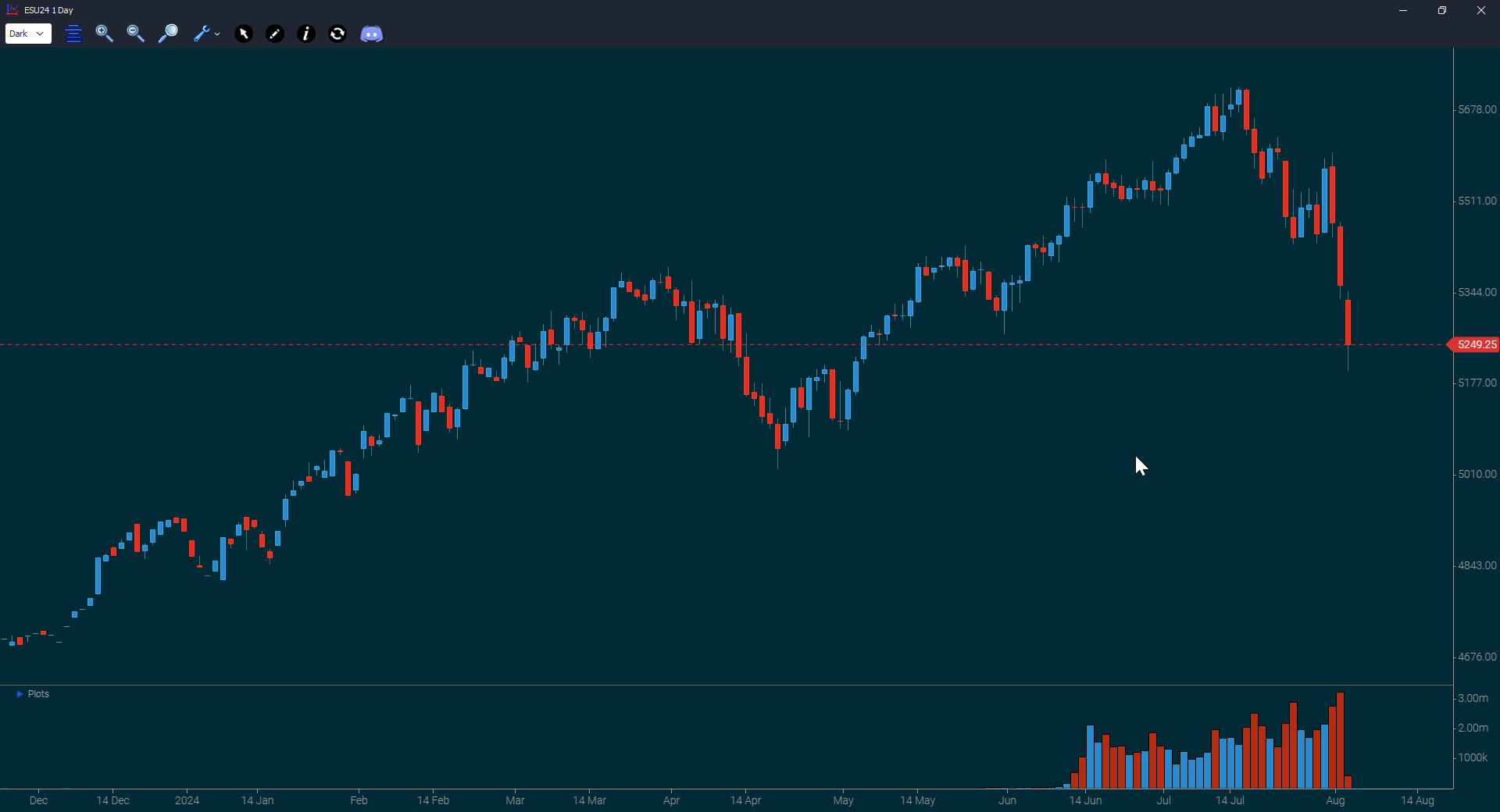

As of writing, it’s the afternoon in Asia and early morning US. All markets are continuing to sink, following the drop on Thursday and Friday. The Nikkei is down 12% on the day and the Kospi (Korea) is down almost 9% and circuit breakers kicked in to halt trading. Stocks are sinking to around January levels. Money is moving to Bonds and Gold. Certain currencies are rallying – like the Japanese Yen – which worsens their situation and puts them in a sticky situation recovery-wise.

The US markets are down too.

So how do we handle a day like today?

Well – certainly – you can’t handle it like a normal day. What works on ‘normal’ days will not work today if this continues into the US market open. The action will NOT be the same. Guessing the direction is one thing. There’s a pretty good chance the US markets will continue to slide as we open. Still – that does not mean you’ll automatically make money shorting the market…

From an index futures perspective, we’ve dropped a hundred or so points on the S&P500 Future. The underlying market (stock market) is closed. If the futures don’t recover before 9:30 EST, then the first thing the market has to do is re-align the stocks and futures. This will likely mostly be done in the pre-market. Anyway – on days when the Futures move a lot, I always avoid the open as this ‘unfinished business’ needs to be resolved. Stocks obviously won’t open at Friday’s closing prices and to me – I just don’t want to be involved in early trading simply because I’ve found this situation to be a tough trade.

After that – if the markets do take a dive, then there is obviously opportunity to the downside. You might head into a day like this thinking that it’s an easy short. The problem though when this stuff occurs, is the market rarely goes down in a straight line. There will be pullbacks and they are likely to be big. It’s going to whipsaw around a lot. Using your ‘normal’ stop size is almost guaranteed to cause a loss. I believe it’s better to scale into positions on days like this. Starting small building some buffer and gradually building your position.

In addition to this, there is a very real chance of a sudden escalation of tensions in the Middle East at any time. People already have the jitters about the markets and any poor economic data is likely to exacerbate that. So keep an eye on the economic news but also keep an eye out for any political or central bank comments about the markets/economy – for example – we might hear mention of interest rate cuts which should be bullish. Also – keep an eye on the news from the Middle East – if there is a serious escalation, it is likely to hit the market hard.

There are arguments for and against trading on days like this. On the one hand – it’s risky. On the other hand, our job as traders is to capitalize on the opportunity the market provides. Some days are low-opportunity days. A day like this is one of the higher opportunity days BUT hand-in-hand with that is higher risk. All days are definitely not equal in terms of the ability to make/lose money.

Either way – it’s good to get experience in days like this, so even if you don’t trade it – it’s not a terrible idea to SIM trade it and get to know the personality of a day like this so you can be more confident to trade it next time.

Try to not lose your pants, people!

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments