Well done Mr Gekko! Consistency Pays – $500 for Winning the October Trader Leaderboard Contest

At the start of October we launched the first of our Monthly trader leaderboard contests. The winner is Laszlo from Hungary AKA Mr Gekko. Laszlo is a trader I’ve spoken to on many occasions and he’s a very level-headed trader that takes his trading very seriously. We’ll look at his results in a second but first, I have to share the chat log with you because he didn’t actually believe there was a prize when I contacted him about it….

[11/2/2017 12:53:09 PM] Peter Davies: Looks like you won the October leaderboard

[11/2/2017 1:41:52 PM] Laszlo: Wait…. I am missing something. I also won it last month. so what is special about it now?

[11/2/2017 2:00:31 PM] Peter Davies: You won October, right?

[11/2/2017 2:00:38 PM] Peter Davies: So you get $500

[11/2/2017 2:01:33 PM] Laszlo: real money?

[11/2/2017 2:01:47 PM] Peter Davies: I can make it SIM money if you like

[11/2/2017 2:02:08 PM] Laszlo: wait..

[11/2/2017 2:02:46 PM] Laszlo: I didnt know that… I thought it is just a competition.

[11/2/2017 2:02:46 PM] Laszlo: wow

[11/2/2017 2:03:02 PM] Laszlo: my desk fee covered 🙂

[11/2/2017 2:03:04 PM] Peter Davies: no – it’s for real $$$$

[11/2/2017 2:03:34 PM] Laszlo: I thought I had my best day for this week yesterday, but looks like I was wrong 🙂

[11/2/2017 2:04:12 PM] Laszlo: wow

[11/2/2017 2:04:22 PM] Laszlo: I really get 500$?

[11/2/2017 2:04:32 PM] Laszlo: are u kidding now?

[11/2/2017 2:04:40 PM] Peter Davies: LOL….. Yes – you get $500

[11/2/2017 2:05:06 PM] Peter Davies: That’s made my day too – funniest thing – the winner didn’t know he was in a comp for money….

[11/2/2017 2:05:19 PM] Laszlo : what a great start of this day….

So once convinced, we managed to get his Paypal account details and now he’s $500 better off!

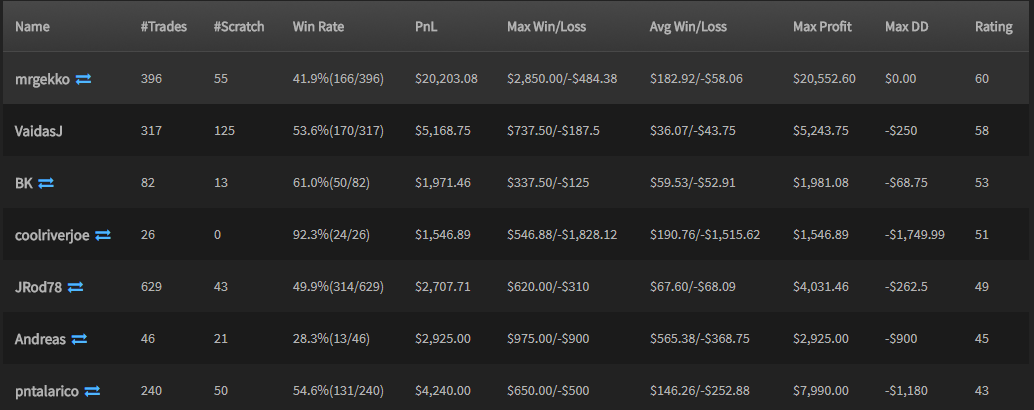

So how did Laszlo win? As you know, the trader leaderboard rates by consistency. That means the highest earner might not necessarily be the winner. After all you could just take one big swing at the market on the last day and beat the P&L of the top trader there to win. Here’s how the top of the leaderboard looked:

We can see that the last in the list there has more profit than many of those above him but his consistency rating is lower. Number 4 in the list has a 92% win rate but a lower rating too. So the first thing we can see about consistency is that the win rate isn’t that important. Laszlo trades at a little over 40% win rate but his losers are consistently small even his largest loss is quite manageable – just over 2x his average loss. So partly, it’s about taking small risks consistently.

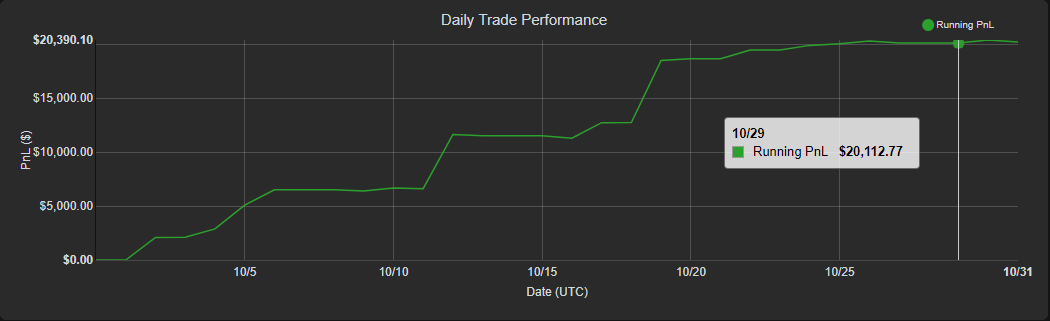

Equity curve for October (Jigsaw Peak Performance Dashboard)

Equity curve for October (Jigsaw Peak Performance Dashboard)

Looking at the P&L, we can see there were no major drawdowns and we had a couple of big up days. Now, you might think these big winning days are a type of inconsistency. After all, those days are not consistent with the average winning day. Prop firms reward this though. Scaling into winners or pushing the advantage when the opportunity arises, is considered a very profitable trait. So you churn out regular profits on normal days and then you take advantage of the days where the opportunity is there. For those of you that traded in October, you’ll know that we were switching from low volatility days to high volatility and back again. So opportunity wasn’t always there. Laszlo traded a pretty wide range of instruments too:

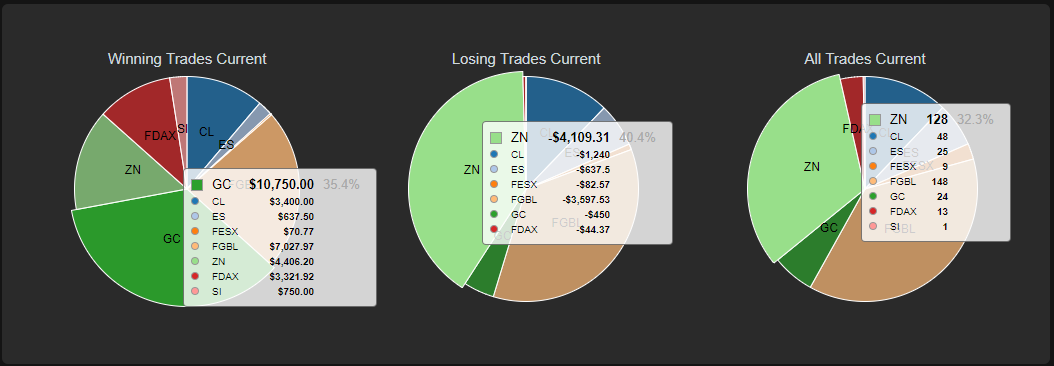

Instrument Breakdown for October (Jigsaw Peak Performance Dashboard)

Instrument Breakdown for October (Jigsaw Peak Performance Dashboard)

This month at least. Laszlo fared best on thinner instruments, quite a lot better in fact but that could just be down to the volatility. It’ll be interesting to see how changes in volatility impact traders, although now it’s November, we only have 3 or 4 weeks before volatility drops again. For the number crunchers amongst you, here are the overall stats:

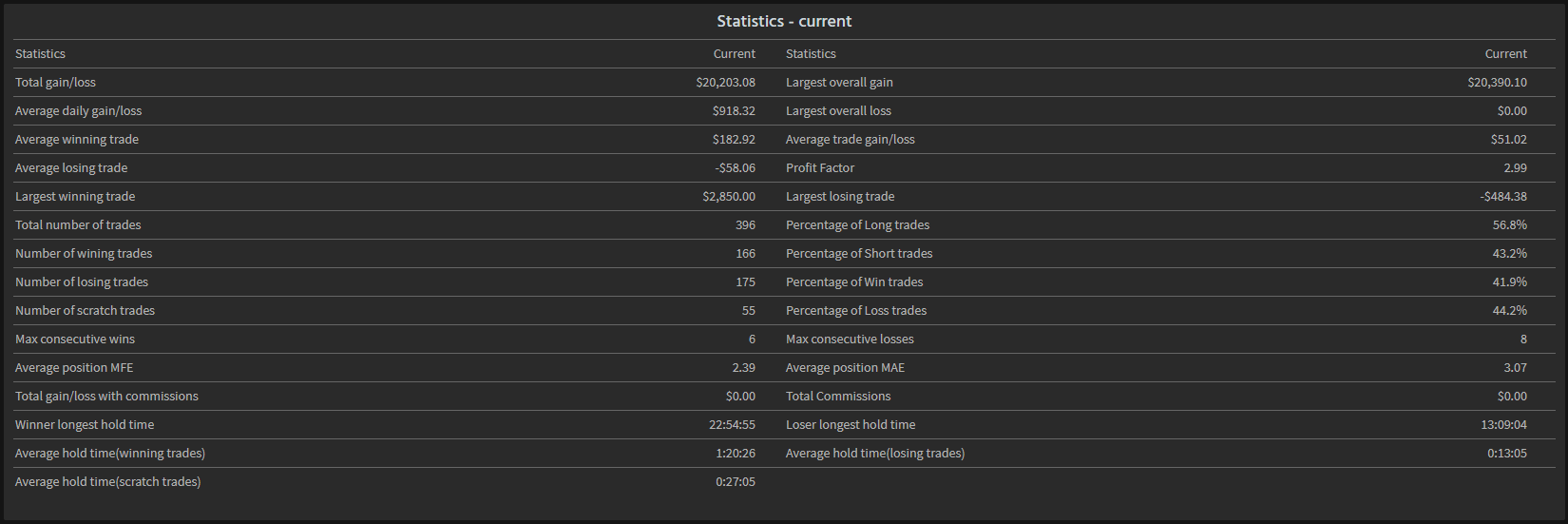

Statistics for October (Jigsaw Peak Performance Dashboard)

Statistics for October (Jigsaw Peak Performance Dashboard)

So well done Laszlo! Very consistent trading and I hope seeing this helps other traders that it’s not all about win-rate. The most consistent won’t be the most profitable each month – but they will be over time!

For November, we are keeping the trader leaderboard prize at $500 but I’ll be rallying around this month for vendors to chip in some more prizes for the end of the year. We may well keep those prizes for February though as Dec/Jan are holiday times and it makes more sense to have the New Year prizes at the first tradable month of the year. For those not signed up to the trader leaderboard yet, follow the instructions – Click Here

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments