Data lags in high volume markets

I’ve had lots of emails/calls lately about the following phenomenon:

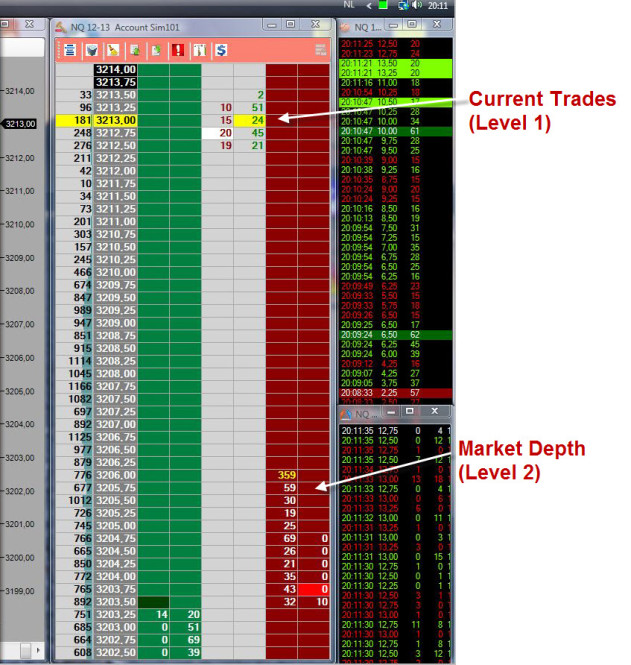

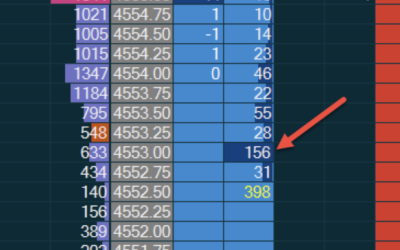

As you can see, the price that current trades are printing at is very far from the inside bid/offer is on the depth. This looks very much like a bug in the Jigsaw Depth & Sales. In fact, this is a data issue and in this post, I’ll explain what the problem is and why it occurs and what your options are.

Level 1 & Level 2 feeds are not synchronized

The Level 1 feed contains Trades, Changes to the Inside bid (price, qty) and Changes to the Inside Offer (price, qty). The level 1 feed is used for Time & Sales, Reconstructed Tape, Summary Tape and the Current Trades columns on Depth & Sales. In OEC Trader/S5 Trader, they have something called the “Tickstream” which is roughly equivalent to the Level 1 feed.

The Level 2 feed contains all changes to all Bids & Offers at all levels (including the inside bid/offer).

These 2 feeds are independent of each other. They are separate streams of data.

Level 2 feed is “fatter” than Level 1 feed

The Level 2 feed contains a lot more information than the level 1 feed. It has more data and consumes more resources and bandwidth. Therefore the Level 2 feed can lag behind the Level 1 feed. This lag can be on the side of the servers that distribute the data or in the networks that get the data out. They can simply become overloaded. These servers cannot distribute an infinite amount of data and of course, different data providers have different server/network infrastructure and capacity.

Some feeds prioritize accuracy and some feeds prioritize performance

There’s 2 types of feed. Execution Feeds (IB, TT, Rithmic) and Data Vendor Feeds (IQFeed, Kinetick).

An Execution Feed will filter out updates to ensure that lags are kept to a minimum. This makes them less accurate. This is typically shown by prints being shown on the wrong side as we move through prices. Market Sells showing up as Market Buys (and vice-versa). Some are better than others – TT is better than IB and Rithmic is better than TT in terms of accuracy. Order Flow traders generally like to see a more accurate feed because they want to see which side market orders are hitting.

A Data Vendor Feed won’t filter out anything. That means at peak times, it will send every message. That can cause lags between Level 1 and Level 2 and there’s not much you can do about it because the issue is not on your end. What you can do is call the Vendor to make sure they are aware of the issue.

But my OEC/NinjaTrader DOM is OK – only Jigsaw has an issue

It does look that way but what is happening on your other DOM is that Level 2 is lagging, you just have no way to confirm it. Open up a Tickstream (OEC) or a Time & Sales (NinjaTrader) and you will see the prints are quite far from the Bids & Offers. When you buy at market, your fill will appear to be far from current price because you are looking at the Bids & Offers and they are lagging.

With Jigsaw, we show Level 1 & Level 2 side by side, so you can instantly see the issue. This heads-up saves you from trading off old Bids & Offers.

Can Level 1 lag behind Level 2?

Level 1 is thinner than level 2 but it can lag. This is not something that occurs often but I have seen it. This is indicative of a problem at your provider end and not just an overload.

So which type of feed is best?

I prefer to use a Data Vendor feed. This is just my personal choice. I use IQFeed, Kinetick and S5 Trader feeds. There are times when they lag and sometimes that can be painful but my personal preference is for accuracy. That is just a personal preference, I know people that get on fine with execution feeds.

Simplify Your Trading

Take a look into the decision making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments